Both options include online access to all program fixes as well as updated tax tables throughout the year.

Checkmark payroll 2015 pro#

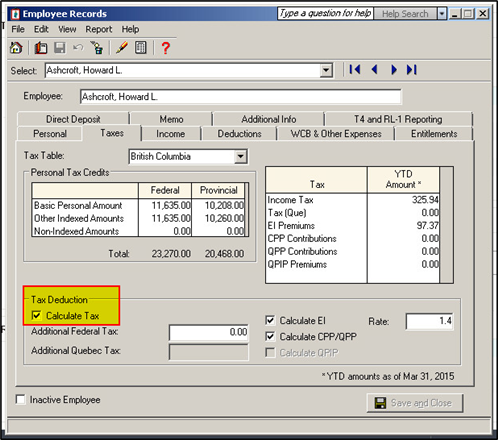

Well suited for small businesses, as well as accounting firms that handle payroll for multiple clients and prefer a desktop payroll application, CheckMark Payroll Pro is $429.00 while CheckMark Payroll Pro+ is $499.00. Support can be accessed via telephone, email, or fax. Users can request support directly from the program, with two levels of support plans available Pro+ Support which includes up to 300 minutes of support, and Pro Support, which includes 90 minutes of support. A searchable knowledgebase is also available, as are a variety of product tutorials. CheckMark offers a variety of related services that can be utilized by companies that purchase CheckMark Payroll, including HR Support and Time and Attendance, which are priced separately from the payroll application.ĬheckMark Payroll offers Help functionality from the main user interface screen, along with access to a Quick Start Guide and the complete Payroll manual. Users can also export payroll data from CheckMark to QuickBooks using a text file format as well.ĬheckMark Payroll does not offer client/employee portals, though employees that sign up for direct deposit can have a paystub emailed to them. The product does integrate with CheckMark Multiledger, which offers GL, AP, AR, Inventory, and Job Management modules. Reports are easily processed, but offer little customization capability, though they can be saved as a text file, or as a Microsoft Excel spreadsheet, where the report can be customized if desiredĬheckMark does not offer direct integration with any timekeeping applications, though users can import time in a text or Excel format. Various tax, income and deduction reports are available as well. Users can also easily print all federal, state, and local tax reports, and users can e-file both W-2’s and W-3’s to the SSA as well as the majority of states that currently permit electronic filing.ĬheckMark Payroll offers several payroll-related reports, including an Employee Information Report, Employee Earnings Report, and an Employee Check Register. CheckMark Payroll prints payroll tax forms including 940, 941, 943, W-2, and W-3 forms, printing on both pre-printed forms as well as blank paper. territories, with tables updated periodically throughout the year to ensure accuracy. Tax tables are offered for all 50 states and U.S. Users can also set up additional pay options during the setup process if desired.ĬheckMark Payroll supports both bonus and after-the-fact payroll, with users able to record the checks directly into CheckMark to ensure accurate reporting. Hours can also be entered manually, using the grid that displays all current employees for each particular company, as well as Regular and Overtime Hours, Sick, and Vacation Hours. When ready to enter hours, users can import hours via text format, which matches hour totals to employee names or social security numbers. Once this is open, a vertical menu will be displayed on the left side of the screen that offers Setup, Payroll, and Report options.Ī variety of detail can be set up for each employee, including personal information, Wages, Taxes, Income, Deductions, Accrued Hours, and a YTD option.

Users can access the File option on the main user interface in order to choose the appropriate company file.

CheckMark is best suited for small businesses, and can also be used by accounting professionals that offer payroll and accounting services to their clients.ĬheckMark Payroll supports multiple companies, making it a good choice for accounting professionals handling payroll for multiple clients.

Checkmark payroll 2015 windows#

CheckMark also offering accounting and payroll solutions to Canadian businesses.ĬheckMark applications are designed as stand-alone applications that are installed on desktop computers, and can be used on both Windows and Macintosh operating systems, with a cloud-based payroll option available in Canada.

Checkmark payroll 2015 professional#

From the 2018 reviews of professional payroll systems.ĬheckMark Payroll is part of CheckMark’s suite of accounting and payroll applications that also includes CheckMark Multiledger, 10.

0 kommentar(er)

0 kommentar(er)